-

-

Planning for the future

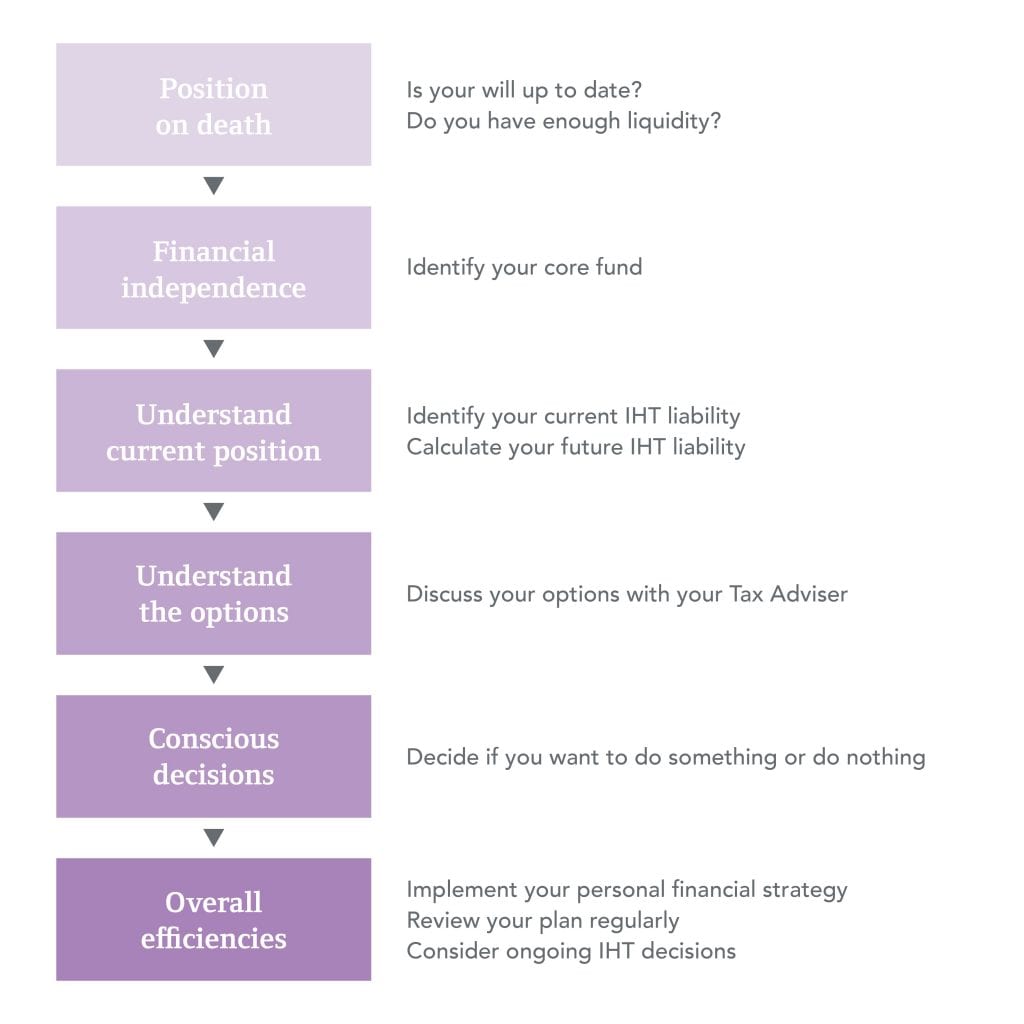

Inheritance Tax (IHT) is often something that people don’t find out about until it’s too late. With the current rate of IHT being 40% it makes sense to think about your affairs now, as a review could result in simplifying your estate for your family after your day.

Our IHT work focuses on effective planning – forewarned is forearmed when it comes to IHT. Our tax specialists will review your estate and calculate your likely exposure to IHT and then work with you to ensure your estate is structured in a manner that not only reflects your wishes but does so in a tax efficient manner.

Trusts

Many people are happy to pass on assets to the next generation as part of a retirement or IHT planning exercise, but some people struggle with the idea of not being in control anymore.

You may already have family trusts in place and our trust experts will ensure that what often seems like a complicated matter is dealt with clearly and efficiently. Our experts have many years’ experience between them and can assist with the following:

- Trust and Estate accounts and Tax Returns

- R185’s for beneficiaries

- Advice in relation to distribution levels

- Inheritance Tax returns

- Ten year anniversary and Exit charges

We work closely with David Allen Financial Services and will always provide a joined up approach, ensuring we both work in your favour. Often the best results will be a combination of investment solutions and conventional planning.