-

Share

-

As part of the Spring budget, the chancellor, Rishi Sunak, announced a new capital allowance ‘super-deduction’. It was intended to spur investment, boost productivity and aid post pandemic economic recovery by providing 25p off company tax bills for every pound of qualifying spending on plant and machinery.

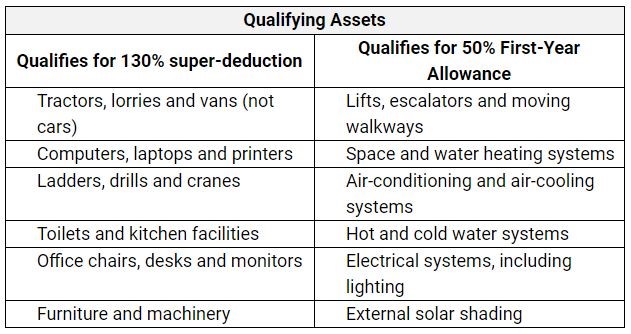

The super-deduction tax break means that you can claim 130% of what you spend on equipment for your business, e.g., Computer equipment, against taxable profits. This would usually qualify for Annual Investment Allowance which provides 100% tax relief on qualifying assets.

Similarly, for expenditure incurred between 1 April 2021 and 31 March 2023, companies can claim a 50% first year allowance for Special rate (including long life) assets. This would usually qualify for 6% writing down allowances.

- The ‘super-deduction’ is only for companies, it is not available to individuals trading as sole traders or in professional partnerships

- There is no expenditure cap on either of the two reliefs and no limit on the amount of deduction

- The reliefs do not apply to plant and machinery that is used or second-hand

- The expenditure must be ‘new’ expenditure. Laptops, PCs, Monitors, Servers, all qualify for the tax break, see below for further examples

It is hoped that the tax break will give companies a strong incentive to make additional investments, and to bring planned investments forward.

Here at David Allen IT Solutions, we use ConnectWise Sell, a procurement system that allows us to pull and compare pricing from multiple hardware and software distribution partners. This enables us to give you quick access to the most competitive product quotes around, saving you the time and the manual process of contacting different vendors.

We can provide a no obligation online quote within 12 hours of the initial request and acknowledge digital quote acceptance with e-signature.

Our team of consultants can help identify the right hardware to purchase for your business requirements, looking at your current IT infrastructure and give advice on your current hardware that may need replaced or upgraded in the near future.

If you require more information specifically on how the ‘super deduction tax break’ might benefit your business please don’t hesitate to get in touch with us.