-

Every single one of us has been affected in some way by the Global Pandemic, and one sector that has constantly been in media focus, is children’s education, and the impact that covid will have on this generation’s future.

Many students leaving school with the required grades in their pocket to qualify for their desired university course, have actually spent most of their time over the last 12 months doing their studies online. There are an incredible number of school-leavers who have completely missed their first year of university, thus not experiencing ‘the best three years of your life’ and crucially not getting the true idea of the actual full cost of those three years.

However, with students now able to return to their university and halls of residence, the cost of this will soon become apparent to both them and ‘the bank of mum and dad’.

Giving an exact figure for how much it costs to go to university is a difficult task because there are so many variables that affect the final total. However, using official data and the findings from National Student Money Survey (NSMS), it is estimated that the rough cost is around £57,000!

Breaking this down into two components:

- Tuition costs which are approximately £9,250 a year in England

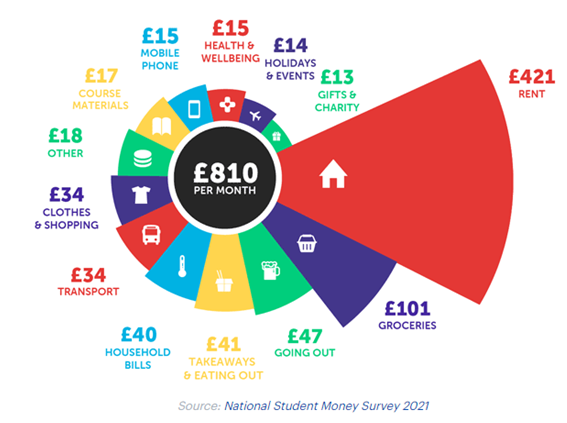

- Living costs, which are harder to work out but based on average cost of living equate to £9,720 a year, and can be broken down further

Whilst these numbers may seem eye watering there is support out there. Certainly for the tuition fees, in the form of grants and loans, however, with regards to the latter these do need repaying at some point in the future when you begin working and it’s important to note that as with any form of liability, the interest on the loan starts from the day you take it out!

Cleary for those not wanting to, or not able to access the ‘bank of mum and dad’ it may be that they will need to consider part time work to make up the additional costs of living.

For those parents of children several years away from University, but with a desire for their loved ones to progress to higher educaation from the age of 18, planning can be put in place now to soften the financial burden. There are various savings plans that can be arranged for your children, to build a future nest egg for them.

If it is to assist with University costs, the Junior ISA’s could be good option. These have an annual contribution limit of £9,000.00 and provide tax efficient growth on the monies invested into them, and regards to the latter, investment can be made into cash, for shorter term planning, or Stocks and Shares for those looking for greater growth potential over a longer term.

A JISA can be set up by a parent or guardian for children below the age of 18. The parent or guardian will contribute to the account but only the child can access the money – and only after they turn 18, which ties perfectly in with University.

The parent or guardian can only open a Junior ISA if the child is under 16, but the sooner one can be opened for a child the better, as the account will benefit from compounding and with a longer time horizon can afford to take more investment risk. And with tax-free returns, the money you invest has the potential for further growth.

Should you wish to start planning early for your children or indeed you want some guidance on the student loan system for children heading back to or considering University, please do not hesitate to contact our experts.